Table of Content

This chart was published around the same time as the group’s long-range mortgage forecast. Low-income families have borne the brunt of the economic crisis, partly because the hardest-hit industries employ low-wage workers. Although the labor market is expected to improve, in CBO’s projections, the unemployment rate remains higher through 2030 than it was before the pandemic. Specific mortgage rates will vary based on factors including credit score, down payment, debt-to-income ratio and loan-to-value ratio.

Other factors are projected to push real interest rates up from their earlier average, but not by enough to offset the factors pushing rates down. Federal debt is projected to be higher as a percentage of GDP, increasing the supply of Treasury securities. And a larger share of income will come from capital, increasing returns on capital assets with which Treasury securities compete.

Mortgage rates are expected to remain historically high into 2023, but you can lower your interest rate today

A positive value indicates that GDP exceeds potential GDP; a negative value indicates that GDP falls short of potential GDP. By 2028, real GDP reaches its long-run level relative to potential GDP and grows at the same rate as potential GDP thereafter. The market for immuno-oncology drugs and therapies is expected to grow at a 15% CAGR, from $60 billion in 2021 to $194 billion by 2028. Higher rates mean more pain for the economy and corporate earnings and spur investors to move money from stocks to less risky bonds. Federal Reserve Board Chairman Jerome Powell speaks during a news conference after the Federal Reserve announced that it would raise interest rates by a 0.5 percentage point to 4.5.

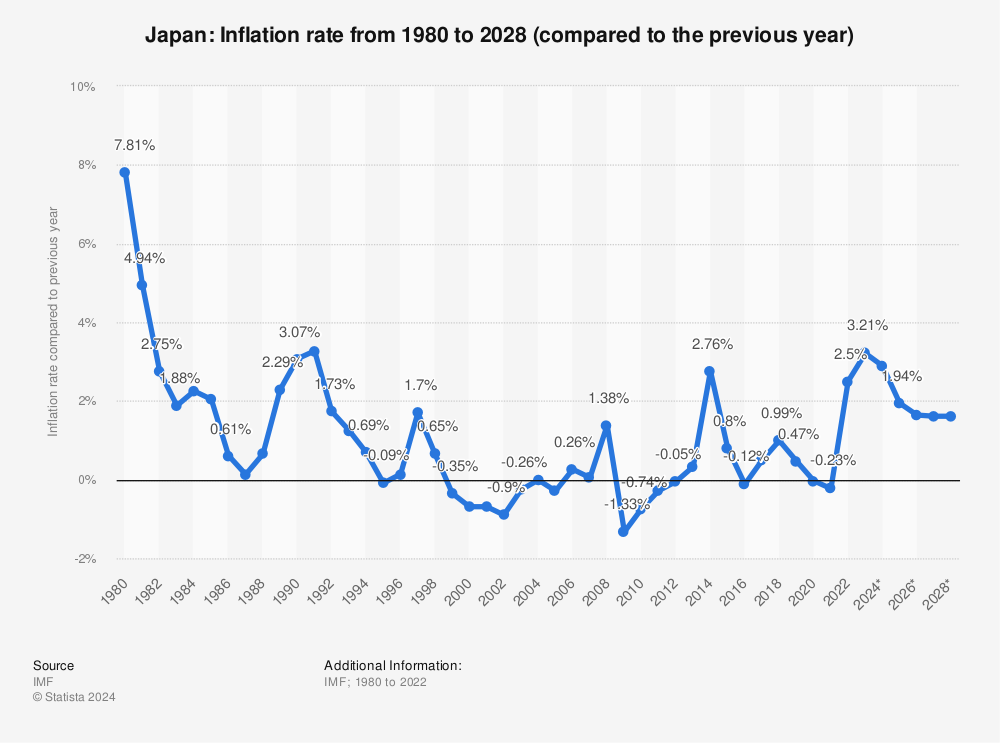

Real GDP recovers rapidly over the next several quarters in CBO’s projections, rising from more than 6 percent below its potential at the end of 2020 to less than 4 percent below its potential at the end of 2021. The growth of real GDP then slows, and output remains far below its potential for several more years. The unemployment rate remains above its prepandemic level through the end of the projection period. The unemployment rate is projected to peak at over 14 percent in the third quarter of this year and then to fall quickly as output increases in the second half of 2020 and throughout 2021. Interest rates are rising, inflation is expected to hit eight per cent by the end of the year. Such developments bolster the economy but could well fuel more inflation.

Current mortgage interest rates chart

Real values are nominal values that have been adjusted to remove the effects of changes in prices. It is similar to the May forecast for those two years, except that the projection of growth in the second half of 2020 has been revised downward. Meanwhile, the S&P 500 index has tumbled about 4% since the Fed announcement, giving back much of the 7.5% gain over the prior six weeks, sparked largely by the encouraging inflation reports and hopes for a less aggressive Fed. Consumer prices rose 7.1% annually in November, down from 8.2% in September and a 40-year high of 9.1% in June, according to the Consumer Price Index. Fed Chair Jerome Powell said the Fed has a “ways to go” before it takes a breather and holds rates steady. Savers might think they should cheer the news that rates will climb in 2022, but all signs point to a likelihood that offerings won’t be that much more attractive.

There’s a chance that increasing construction may offer some relief in the inventory department. Last month’s residential construction report from the Census Bureau saw building permits and housing starts both increase over the year. Builder confidence was at a 20-month high, according to the National Association of Home Builders. According to Ralph DeFranco, chief economist for mortgage insurer Arch MI, entry-level home prices will rise higher than incomes next year—and disappointing construction numbers will only compound the issue.

Should you wait for lower rates?

The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Another important distinction is between fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are fixed for the duration of the loan.

Other popular vehicles — money market and savings accounts — should average nationally at 0.12 percent and 0.11 percent, respectively, by the end of 2022. Markets keep eclipsing previous record highs, and the financial system is expected to grow at an above-trend pace for the second year in a row. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Search Homes Now

And so they feel they must raise interest rates higher than planned to make it more expensive for employers to borrow money to hire and invest, damping job growth and wage increases. In other words, the Fed is slowing the pace of its flurry of rate increases this year, which are intended to curtail high inflation. That will better allow the central bank to assess the effects of the aggressive moves, including whether they're about to tip the U.S. into a recession next year as most economists predict. Mortgage rates are currently trending down, but could begin to increase once again.

The most common mortgage terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. For adjustable-rate mortgages, interest rates are set for a certain number of years , then the rate adjusts annually based on the market rate. A 5/1 ARM has an average rate of 5.46%, a slide of 2 basis points from the same time last week. For the first five years, you'll typically get a lower interest rate with a 5/1 adjustable-rate mortgage compared to a 30-year fixed mortgage.

With the oldest members of the generational cohort reaching 38 years in 2019, Millennials broadened their housing horizons beyond the urban core. As housing prices outpaced incomes by a wide margin, home buyers made a noticeable move toward affordability during the year. Large, expensive coastal markets—New York, Los Angeles, San Francisco—began experiencing net migration outflows, as buyers flocked to mid-sized cities, in search of quality of life and amenities at a more affordable price point. Consumer confidence spent the better part of 2019 moving sideways, despite monthly fluctuations. In September, the Present Situation component of the Conference Board Consumer Confidence Index was unchanged compared with the same month in 2018.

Economic activity in the United States started 2019 on an upbeat note, fueled by consumer optimism and business confidence. In addition, exports outpaced imports during the period, leading to expectations of increased trade windfalls. Though mortgage rates were historically low at the beginning of 2022, they have been increasing steadily since. The average rate for a 15-year, fixed mortgage is 5.97%, which is a decrease of 4 basis points from the same time last week. You'll definitely have a larger monthly payment with a 15-year fixed mortgage compared to a 30-year fixed mortgage, even if the interest rate and loan amount are the same.

As interest rates surge, it's getting more expensive to buy a house. In addition to their mortgage rate forecasts for 2019 and 2020, Freddie Mac’s research team shared a number of trends and predictions in their latest report. A recently issued mortgage rate forecast for 2019 and 2020 suggests that average rates could hover below 5% for the foreseeable future. In addition, it is not clear how individuals, businesses, and state and local governments will respond to recent fiscal and monetary policy actions taken by the federal government. International conditions may also change in unanticipated ways as the pandemic works its way through the rest of the world. Despite its forecasts, economists expect the central bank to halt its rate hikes sooner if inflation continues to ease and the economy weakens in coming months.

For adjustable-rate mortgages, interest rates are the same for a certain number of years , then the rate changes annually based on the market interest rate. A 5/1 ARM has an average rate of 5.46%, a fall of 2 basis points from the same time last week. With an adjustable-rate mortgage mortgage, you'll usually get a lower interest rate than a 30-year fixed mortgage for the first five years. However, you may end up paying more after that time, depending on the terms of your loan and how the rate changes with the market rate. For borrowers who plan to sell or refinance their house before the rate changes, an adjustable-rate mortgage could be a good option. But if that's not the case, you might be on the hook for a much higher interest rate if the market rates shift.

No comments:

Post a Comment